Landis+Gyr Announces FY 2019 Financial Results

Zug, Switzerland – May 6, 2020 – Landis+Gyr (LAND.SW) today announced unaudited financial results for financial year 2019 (April 1, 2019–March 31, 2020). Key highlights included:

Landis+Gyr experienced some impacts related to COVID-19 and weakness in demand in North America, as a result net revenue was USD 1,699.0 million, a decrease of 2.0% in constant currency

• Order intake was USD 1,371.4 million, a book to bill ratio of 0.81 driven by low bookings due to the lumpy nature of contract awards and regulatory delays in the US

• Committed backlog down 14.6% year-over-year to USD 2.22 billion

• Adjusted EBITDA of USD 237.2 million, a margin of 14.0%* (13.6% excluding the Brazilian VAT court case ruling) compared to 13.5% in the prior year

• Both the EMEA and Asia Pacific regions experienced sales growth of 3.9% and 12.7% in constant currency respectively. The Americas net revenue declined 7.7% year over-year in constant currency

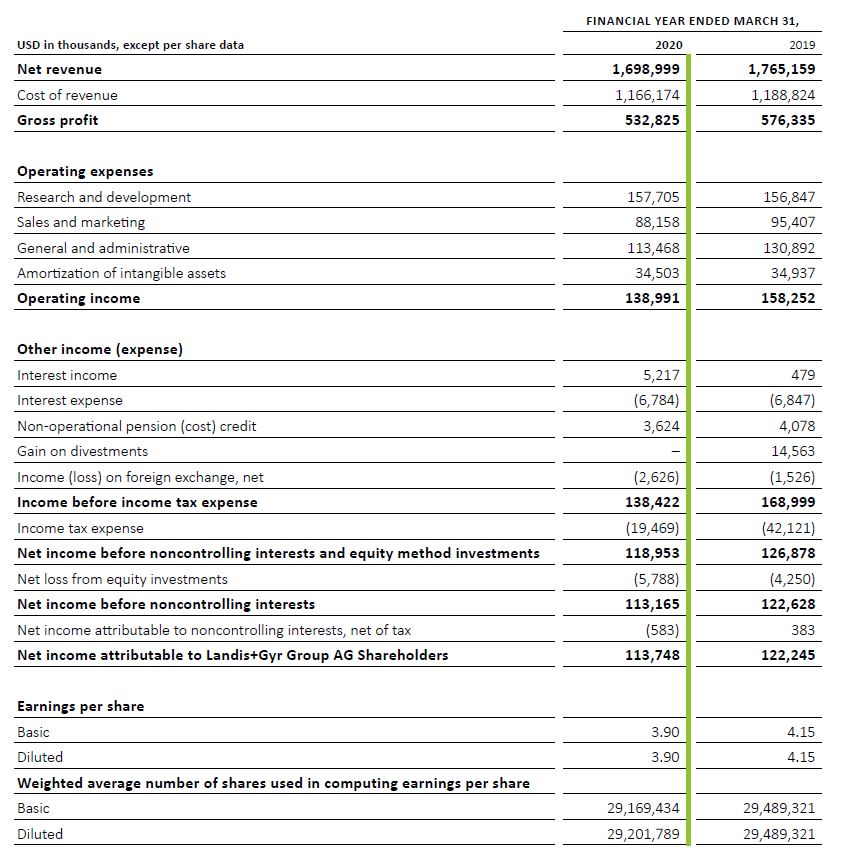

• Net income was USD 113.7 million or USD 3.90 per share, a decrease of 7.0% and 6.0% respectively year-over-year

• Free Cash Flow, excluding M&A, was USD 120.4 million compared to USD 123.5 million in the prior year

• Due to uncertainty arising from the COVID-19 crisis, no FY 2020 financial guidance is being issued at this time

• As a precautionary measure due to COVID-19 driven uncertainty, the Board of Directors will defer the decision on the FY 2019 dividend and intends to revisit the situation in conjunction with the release of the results of the first half year ending September 2020

* includes one-off gain of USD 5.6 million resulting from a Brazilian VAT court case ruling

“Landis+Gyr is a global leader in an essential industry providing critical infrastructure to utilities around the world. Our top priority at this difficult time is to ensure the health and wellbeing of our employees as well as meeting customer requirements. The Group’s balance sheet remains solid. We are well positioned to weather the COVID-19 crisis,” said Werner Lieberherr, Landis+Gyr’s CEO.

“Financial results for FY 2019 were in line with the recently announced expectations and reflect the impacts of both the COVID-19 crisis and previously mentioned regulatory delays in the Americas region. Looking ahead, it is too early to estimate the impact of COVID-19 on the Group’s net revenues and, as such, we are not providing financial guidance for FY 2020 at this time. We have undertaken strict cost control measures throughout the organization while maintaining key portfolio investments and will continue to monitor the situation closely, providing updates when appropriate. Finally, as a precautionary measure given the current COVID-19 driven global economic uncertainty, our Board of Directors has decided to postpone the decision on the proposed FY 2019 dividend for now, and intends to revisit the situation in conjunction with the release of the results of the first half year ending September 2020,” Lieberherr concluded.

Order Intake, Committed Backlog and Net Revenue

Order intake for FY 2019 was USD 1,371.4 million, a book to bill ratio of 0.81 and a decrease of 32.9% year-over-year in constant currency reflecting a demanding year-over-year comparison due to strong FY 2018 performance (FY 2018 book to bill ratio of 1.18), the lumpy nature of contract awards and US regulatory delays. Committed backlog was down 14.6% year-over-year at USD 2,223.9 million. The Americas and EMEA reported decreases in committed backlog compared to the prior year, while Asia Pacific rose slightly.

In FY 2019, net revenue fell 2.0% year-over-year in constant currency to USD 1,699.0 million.

The COVID-19 crisis impact lowered net revenue by approximately 1% in FY 2019.

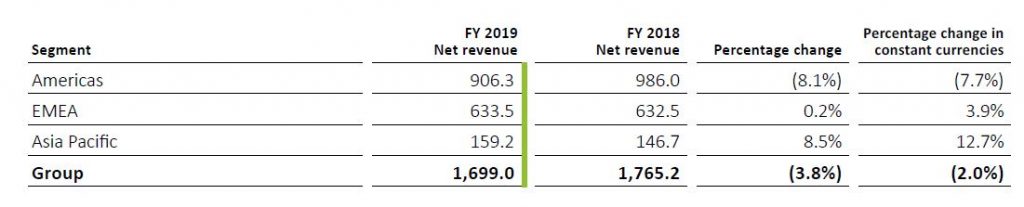

Net revenue to external customers per segment was as follows (in USD millions, except where indicated):

The Americas region delivered lower net revenue year-over-year, falling 7.7% in constant currency, due to delays in regulatory approvals in the US and the rolling-off of two large projects which were running at full deployment speed in the US during FY 2018. The Americas’ committed backlog was USD 1,480.3 million at the end of the financial year, down 15.6% compared to FY 2018.

Net revenue in the EMEA region was up compared to the prior year by 3.9% in constant currency.

Strong volumes in the UK drove the region’s financial year performance. EMEAʼs committed order backlog stood at USD 649.4 million at the period end, down 13.9% year-over-year.

Asia Pacific also achieved higher sales with year-over-year growth of 12.7% in constant currency, as demand in Australia and Hong Kong drove the increase. Committed backlog was USD 94.3 million, up 0.7% compared to FY 2018.

Adjusted and Reported EBITDA

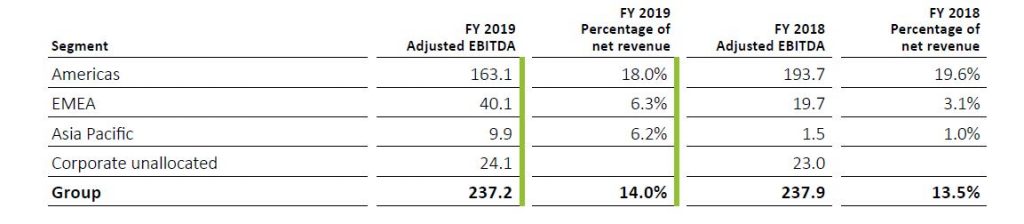

The Adjusted EBITDA by segment was as follows (in USD millions, except where indicated):

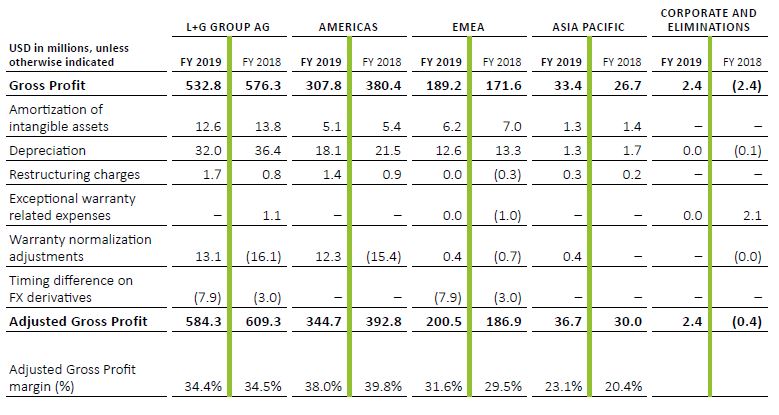

Overall, the FY 2019 Adjusted EBITDA margin increased to 14.0% from 13.5% in the prior year. FY 2019 Adjusted EBITDA came in at USD 237.2 million, including the one-off positive impact of a court ruling relating to overpaid VAT in Brazil of USD 5.6 million; excluding this one-off impact, the Adjusted EBITDA margin for FY 2019 was 13.6%. Continued cost and efficiency improvements in EMEA and Asia Pacific partially offset a revenue driven decline in Adjusted Gross Profit in the Americas’ results.

Project Lightfoot, aimed at bundling and partially outsourcing manufacturing activities to enhance production efficiencies, lower supply chain costs and further reduce capital intensity, is ahead of the initial plan and delivered in excess of USD 20 million of annual savings in FY 2019.

In FY 2019, Operating income was USD 139.0 million, a decline of 12.2% from the USD 158.3 million achieved in FY 2018. Reported EBITDA was USD 225.3 million versus USD 251.1 million in FY 2018. Overall, the FY 2019 EBITDA impact of the COVID-19 crisis on the Group was the consequent flow through of the approximately 1% net revenue reduction.

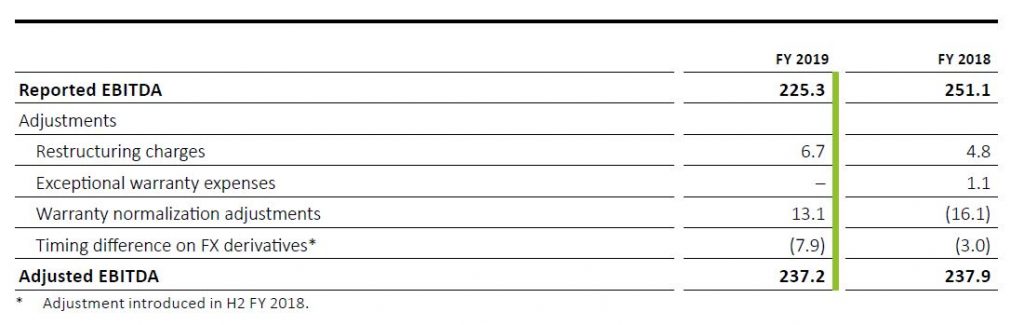

In FY 2019, the adjustments to bridge from Reported EBITDA to Adjusted EBITDA were in three primary categories. Firstly, with respect to Restructuring Charges, the USD 6.7 million related to streamlining measures taken across the organization, with the largest piece coming from the Americas region as the Company worked to lower the Americas’ cost base in light of the regulatory delays. Secondly, the Warranty Normalization Adjustments of USD 13.1 million represents the amount of warranty provisions made relative to the average annualized actual warranty utilization for the last three years. FY 2019 Reported EBITDA included an increase to the legacy component warranty provision in the Americas of USD 28.2 million, net of related insurance proceeds. Thirdly, the Timing Difference on FX Derivatives adjustment was USD (7.9) million in FY 2019. FX hedges generated unrealized gains on a mark-tomarket basis, primarily as a result of GBP exchange rate movements. Finally, the adjustment category of Exceptional Warranty Expenses was nil for FY 2019.

The adjustments made to bridge between EBITDA as reported in the Group’s financial statements and Adjusted EBITDA are as follows (in USD millions):

Net Income and EPS

Net income for FY 2019 was USD 113.7 million, or USD 3.90 per share, and compares to USD 122.2 million, or USD 4.15 per share, for FY 2018, a decrease of 7.0% and 6.0% respectively, the one percentage point difference being attributable to the impact of the share buyback program on EPS.

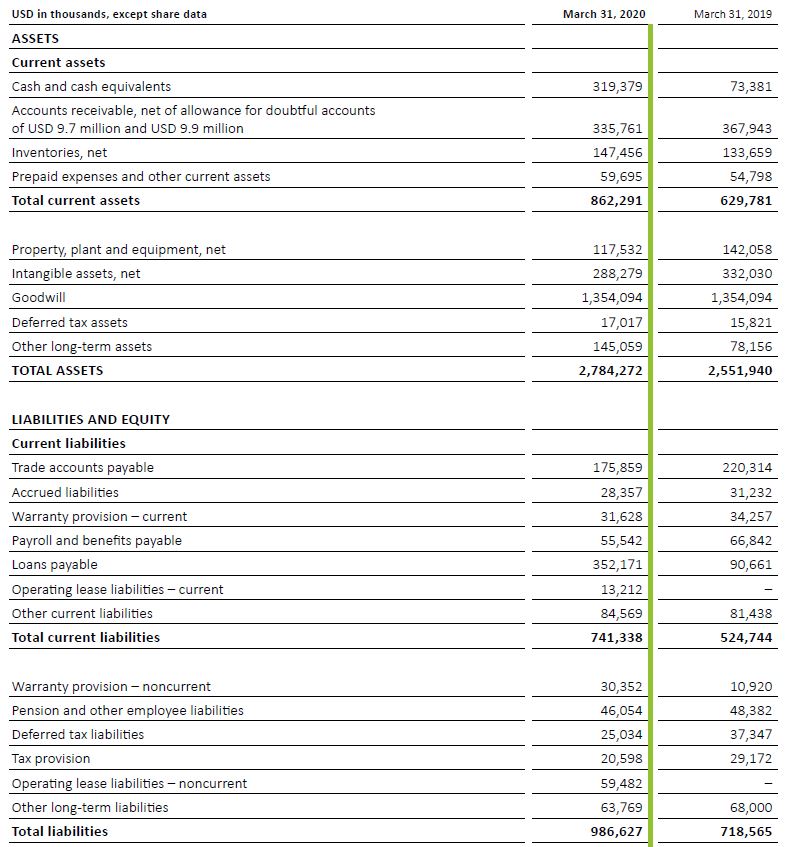

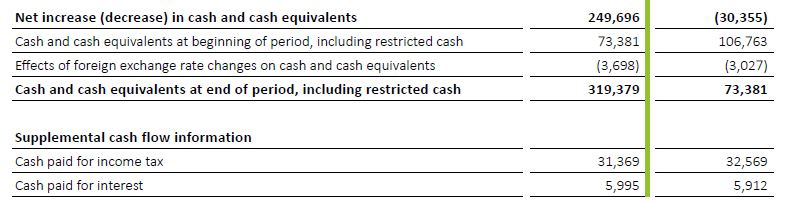

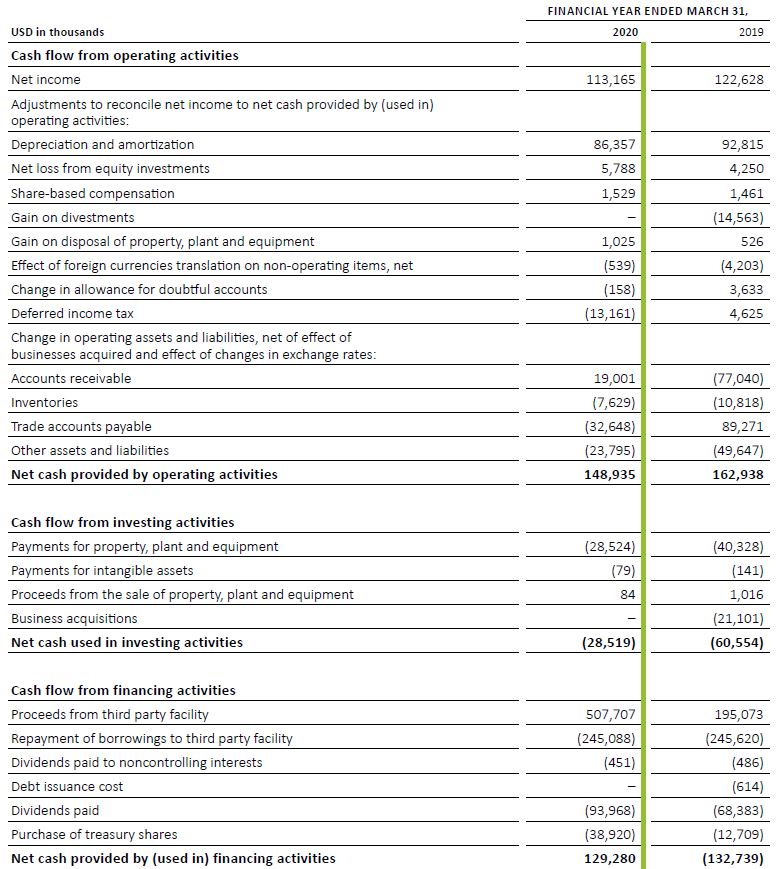

Cash Flow and Net Debt

Cash provided by operating activities was USD 148.9 million in FY 2019 compared to USD 162.9 million in the prior year.

Free Cash Flow (excluding M&A) was USD 120.4 million in FY 2019, a decrease of USD 3.1 million

compared to FY 2018.

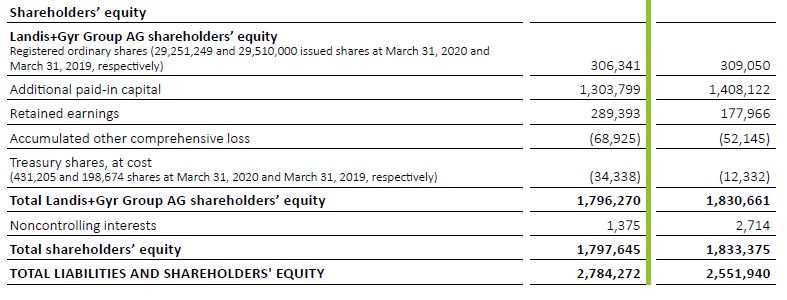

In FY 2019, capital expenditure amounted to USD 28.6 million, 29.4% below the FY 2018 level of USD 40.5 million, consistent with the Company’s asset-light business model. As of March 31, 2020, the ratio of net debt to Adjusted EBITDA was 0.1 times, with net debt of USD 32.6 million, after the payment of USD 94.0 million in FY 2018 dividends and USD 38.9 million for share repurchases, both inside and outside the share buyback program, during FY 2019. The share buyback program was approximately 43% complete when it was suspended on March 27, 2020.

Distributions to Shareholders

As a precautionary measure due to the uncertainties surrounding the COVID-19 pandemic and the current business environment, the Board of Directors will not propose a dividend to the June 2020 Annual General Meeting. Rather, the Board has decided to defer the decision on the FY 2019 dividend and intends to revisit the situation in conjunction with the release of the results of the first half year ending September 2020. By taking this measure, Landis+Gyr further strengthens an already robust level of liquidity, adding support to the company’s overall financial position in view of the uncertainties stemming from the present crisis. A further announcement will be made at the time of the release of the Group’s first half FY 2020 results on October 28, 2020. In that context, the Group Executive Management will take a 10% reduction in base salary for 6 months, and the members of the Board of Directors will likewise have their base and committee fees reduced by 10% for six months as well.

The share buyback program remains suspended.

FY 2020

Landis+Gyr is unable to estimate the FY 2020 net revenue impact from the COVID-19 crisis, but it could have a material effect. Therefore, the Company will not be providing guidance for the financial year 2020 at this time. The impacts vary widely with most North American customers currently continuing to deploy meters, though the pace differs by utility. Several key customers in EMEA have currently suspended or delayed installations, notably in the UK, France and the Netherlands. No major project cancellations have occurred, and Software and Services contracts remain on track. Although there is currently no major impact to the supply chain, risks remain as this is an evolving position which changes day by day. The Group’s factories comply with relevant government policies and are subject to lockdowns in some countries.

Recent Corporate Developments

• At the last European Utility Week tradeshow, the Company introduced its Gridstream® Connect solution for European utilities. Gridstream Connect is an open, secure and scalable Internet of Things (IoT) platform designed to unlock added value and maximize efficiencies from advanced metering infrastructures (AMI) by bringing together intelligent endpoints, communications, software and applications.

• In North America, Landis+Gyr introduced the next generation of electric meters with leading-edge grid sensing technology in January 2020. The Revelo metering platform builds on Landis+Gyr’s deep metering experience that spans residential, commercial and grid sensing, taking full advantage of the strength and success of these technologies.

• In January 2020, Landis+Gyr released an omni-carrier cellular meter and services solution to simplify installation and operation of cellular communications for utility IoT applications. A first of its kind for North America, Landis+Gyr’s LTE-M cellular meter is omni-carrier capable, with a single meter model that is capable of supporting a variety of available cellular carriers and is fully integrated with RF mesh capability.

• On April 1, 2020 Werner Lieberherr became Landis+Gyr’s Chief Executive Officer.

• In April 2020, Landis+Gyr announced the award of an Advanced Metering Infrastructure (AMI) contract by The Hongkong Electric Co., Ltd. (HK Electric) in support of Hong Kong’s transformation into a smart city.

Investor Webcast and Telephone Conference

The management of Landis+Gyr will host an investor/analyst call to discuss the Company’s results.

Date and time: May 6, 2020 at 09:00 am CET

Speakers: Werner Lieberherr (CEO) and Jonathan Elmer (CFO)

Audio webcast: www.landisgyr.com/investors

Telephone: Europe: +41 (0)58 310 5000

UK: +44 (0)207 107 0613

US: +1 631 570 5613

Please dial in 10–15 minutes before the start of the presentation and ask for “Landis+Gyrʼs financial year 2019 results”.

Contact

Stan March

Phone +1 678 258 1321

Stan.March@landisgyr.com

Christian Waelti

Phone +41 41 935 6331

Christian.Waelti@landisgyr.com

Key Dates

Publication of Annual Report 2019

and Invitation to AGM 2020 May 28, 2020

Annual General Meeting 2020

(virtual meeting) June 30, 2020

Release of Half Year Results 2020 October 28, 2020

Release of Sustainability Report October 28, 2020

About Landis+Gyr

Landis+Gyr is the leading global provider of integrated energy management solutions for the utility sector. Offering one of the broadest portfolios, we deliver innovative and flexible solutions to help utilities solve their complex challenges in Smart Metering, Grid Edge Intelligence and Smart Infrastructure. With sales of USD 1.7 billion, Landis+Gyr employs approximately 5,700 people in over 30 countries across five continents, with the sole mission of helping the world manage energy better.

Disclaimer

This release contains information regarding alternative performance measures. Definitions of these measures and reconciliations between such measures and their USGAAP counterparts if not defined in this release may be found on pages 36 to 42 of the Landis+Gyr Half Year Report 2019 on our website at www.landisgyr.com/investors.

Forward-looking Information

This press release includes forward-looking information and statements, including statements concerning the outlook for our businesses. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions, and the economic conditions of the regions and industries that are major markets for Landis+Gyr Group AG. These expectations, estimates and projections are generally identifiable by statements containing words such as “expects”, “believes”, “estimates”, “targets”, “plans”, “outlook” “guidance” or similar expressions.

There are numerous risks, uncertainties and other factors, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this presentation and which could affect our ability to achieve our stated targets. The important factors that could cause such differences include, among others: the duration, severity and geographic spread of the COVID-19 pandemic, government actions to address or mitigate the impact of the COVID-19 pandemic, and the potential negative impacts of COVID-19 on the global economy, the Company’s operations and those of our customers and suppliers; business risks associated with the volatile global economic environment and political conditions; costs associated with compliance activities; market acceptance of new products and services; changes in governmental regulations and currency exchange rates; estimates of future warranty claims and expenses and sufficiency of accruals; and other such factors as may be discussed from time to time in Landis+Gyr Group AG filings with the SIX Swiss Exchange. Although Landis+Gyr Group AG believes that its expectations reflected in any such forward-looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.

Extracts from the Financial Report 2019

Consolidated Statements of Operations (unaudited)

Consolidated Balance Sheets (unaudited)

Consolidated Statements of Cash Flows (unaudited)

Supplemental Reconciliation and Definitions (unaudited)

Adjusted EBITDA

The reconciliation of EBITDA to Adjusted EBITDA is as follows for the financial years ended

March 31, 2020 and 2019:

Adjusted Gross Profit

The reconciliation of Gross Profit to Adjusted Gross Profit is as follows for the financial years ended March 31, 2020 and 2019:

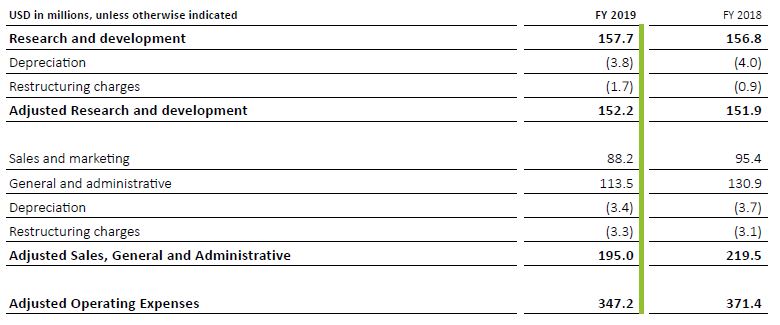

Adjusted Operating Expenses

The reconciliation of Operating Expenses to Adjusted Operating Expenses is as follows for the financial years ended March 31, 2020 and 2019: